The Role of Stablecoins in Making Web3 Payments Practical

Author

Author

What if sending money across borders were as easy as texting a friend? No delays, high fees, or even intermediaries like banks? That’s the promise of stablecoins. Web3 is growing at an incredible rate and so is the need for reliable, fast, and accessible digital payment systems. Traditional cryptocurrencies like Bitcoin and Ethereum were often used as a mode of payment but they had one problem; High price volatility. That is where stablecoins come in.

Stablecoins are digital currencies that are designed to maintain a stable value over time. This is usually done by pegging them to a traditional asset like the US dollar, Euro, or even Gold. This means that with stablecoins, you can enjoy all the benefits of crypto, like speed, borderless access, and no middle men without worrying about price fluctuation.

Whether you are trying to pay a freelancer halfway across the world, send money to family back home, or even make payment for a commodity you purchased online, stablecoins let you do it instantly, without the stress of exchange rates changing overnight or banks taking a cut.

Stablecoins exist in various types based on how they’re backed or how they maintain their price stability. Understanding these types helps you choose the one that suits your needs, whether you’re a casual user, a business owner, or a DeFi enthusiast.

Here’s a simple breakdown of the main types of stablecoins you’ll come across:

Why people trust them: Fiat-backed stablecoins are straightforward and backed by actual money. It’s like a digital version of a dollar bill, just easier to send across the world in seconds.

Why they matter: They’re fully decentralized; Meaning that no banks or central authorities are involved. Making them perfect for Web3 users who don’t want to rely on traditional systems.

How it works: If the price of the stablecoin goes above $1, the algorithm mints more coins to bring the price down. If it drops below $1, it reduces supply to push the price back up. Example: TerraUSD (UST) was one of the most well-known algorithmic stablecoins, but also one of the most infamous, after its collapse in 2022 caused billions in losses across the crypto market.

Why you should be cautious: While the idea is innovative, the lack of actual collateral means algorithmic stablecoins can be risky. If the algorithm fails or loses market trust, there’s nothing backing the coin to stop a death spiral.

Why some prefer them: It’s like holding digital gold, secure, stable, and globally accessible without needing a vault.

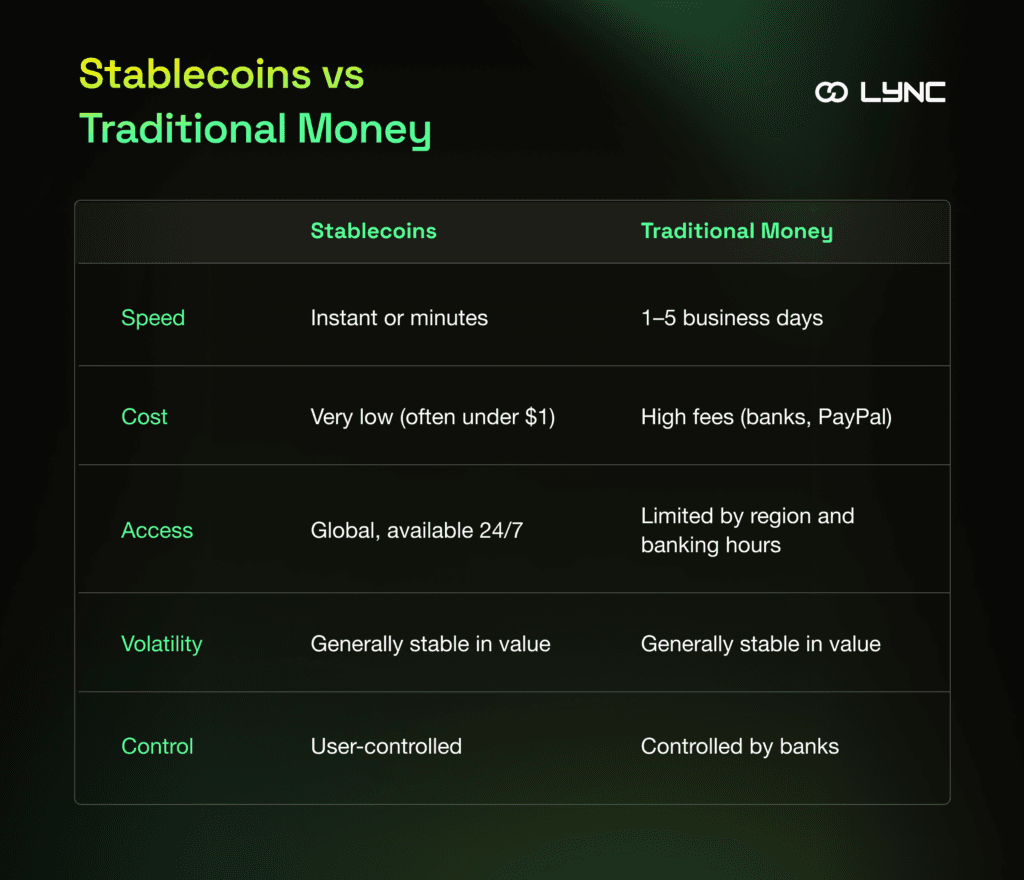

What really makes stablecoins stand out in the world of Web3 payments is how they solve everyday problems people face with traditional money transfers, especially across borders. Imagine you’re a freelancer based in the United States working with clients all over the world. Normally, getting paid can be a headache. Banks take days to process international wire transfers, and the fees can be surprisingly high, often reaching $30 or more per transaction. On top of that, currency exchange rates might eat away at your hard-earned cash.

However, stablecoins are here to flip that whole experience upside down. Sending or receiving money in stablecoins like USDC or USDT happens almost instantly, often for just a few cents or even less. And because these coins are pegged to the US dollar, you don’t have to worry about wild price swings that come with cryptocurrencies like Bitcoin or Ethereum. What you see is what you get. This means that $100 sent today is still worth $100 when it hits your wallet.

LYNC is a cutting-edge platform designed to unlock the true potential of stablecoins for real-world business payments, especially across borders. Our aim is to solve the longstanding challenges of international payments; speed, cost, complexity, and trust, by combining stablecoins with traditional banking infrastructure.

To achieve this, LYNC offers a unique hybrid solution that leverages the best of both worlds: the fast, borderless nature of stablecoins and the trusted security of established banking systems. This innovative approach allows businesses to move money with unprecedented efficiency and transparency, removing the friction that typically slows down cross-border transactions.

With LYNC, businesses can gain access to multi-currency accounts that seamlessly support both fiat currencies like USD, EUR, GBP, and NGN, as well as stablecoins such as USDC. Hence, empowering companies to hold, send, and receive funds instantly across borders with minimal fees, often just a fraction of traditional wire transfer costs.

By bridging the speed and efficiency of blockchain payments with the reliability of established banking networks like ACH, Fedwire, SWIFT, and Faster Payments, LYNC ensures funds move quickly and securely, backed by FDIC insurance for peace of mind. This means businesses no longer have to wait days or pay exorbitant fees to manage international transactions, freeing up capital and streamlining cash flow in a way that was never possible before.

As Web3 continues to grow, stablecoins will play an essential role in shaping the future of how we move money, bringing speed, transparency, and fairness to payments worldwide. Whether you’re a freelancer, a small business, or a global enterprise, embracing stablecoins could be the key to unlocking faster, smarter financial transactions.

November 27, 2025

The world of competitive gaming is global by nature, yet managing backend operations for such a wide-reaching network is no easy task. For companies supporting this rapid, worldwide growth, the key challenge lies in balancing decentralized community building with consistent,...

Author

November 26, 2025

Digital transactions move fast, yet most payment operations still rely on workflows that slow businesses down. Teams spend hours on manual approvals, reconciliations, compliance checks, settlement processes and operational tracking. As volumes grow, these workflows create bottlenecks that limit how...

Author

November 21, 2025

Crypto wallets have evolved from clunky browser extensions to invisible infrastructure that powers everyday apps. A new generation of apps now provide a wallet inside the product flow itself, so users can sign in, store assets and complete transactions without...

Author

November 19, 2025

In late 2025, two of the internet’s biggest infrastructure providers, Cloudflare and Amazon Web Services (AWS), faced major outages that disrupted millions of websites and apps worldwide. Popular platforms like X (formerly Twitter), OpenAI’s ChatGPT, Slack, Fortnite, and Upwork were...

Author

November 13, 2025

A silent revolution is taking place in the digital world. Intelligent agents are beginning to make decisions, negotiate deals, and exchange value with minimal supervision. This new phase of progress is called the agentic economy, a model where AI-powered entities...

Author

November 7, 2025

The gaming world has always evolved, from arcade machines to consoles, from online multiplayer to esports, but few shifts have been as revolutionary as Play-to-Earn (P2E) gaming. In this model, players no longer just play for entertainment; they play to...

Author

November 5, 2025

E-commerce is no longer about clicks, it’s more about conversations. As users spend more time on chat platforms than on traditional websites, the next frontier of online shopping is emerging inside messaging apps. Leading that charge is Telegram, a platform...

Author

November 4, 2025

The digital economy is evolving beyond human-initiated transactions. As AI becomes more agentic, capable of making autonomous decisions, our financial systems are being redefined. The next logical step is clear: payments that not only execute but also think, adapt and...

Author

October 31, 2025

Digital wallets are the entry point into Web3. They act as the keys to decentralized apps, enabling users to send and receive crypto, verify digital identities and manage assets, without relying on banks or intermediaries. But setting up a wallet...

Author

Unlock special content and connect with others.

Join our community today!